what is hospital indemnity high plan

It also provides a 3000 lump sum outpatient. Hospital indemnity insurance is coverage you can add to your existing health insurance plan.

Hospital Indemnity Insurance The Hartford

The average price of a hospital stay for seniors is nearly 15000 for a five-day visit.

. Guardians Hospital Indemnity benefit can help pay for out-of-pocket costs associated with being hospitalized in addition to your medical coverage and can give you more of a financial safety. An indemnity insurance plan pays out the actual expenses incurred. Hospital indemnity insurance can help ease your stress about hospital bills so you can focus more on getting better.

A Hospital Indemnity Insurance policy is flexible and can be tailored to your needs and budget. How does an indemnity plan work. So lets say you have a 6500.

This plan provides limited benefits. To learn more about hospital indemnity insurance and ask specific questions call 888-855-6837 to speak with a licensed agent. In short hospital indemnity insurance is coverage for a cash payout specifically in the event that you are hospitalized.

METLIFES HOSPITAL INDEMNITY INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Hospital indemnity insurance helps by putting recovery first over hospital bills. Hospital expenses average nearly 4000 a day with a typical hospital stay costing more than 15000 total.

Most people purchase a hospital indemnity plan in addition to other coverage like a major medical plan Medicare or Medicare Advantage. However you might not know what it means. Also known as hospital.

Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for. Hospital Indemnity Insurance can help cover some out-of-pocket medical costs associated with a hospital stay. Complement a high-deductible health plan.

There is no one-size-fits-all. Employees can use these. The policy is not intended to be a substitute for medical coverage and certain states.

Some plans offered by Health Benefits Connect can be purchased by a simple online application without medical. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. Hospital indemnity insurance is an insurance plan you can purchase in addition to your health insurance plan sponsored by your employer the government or a private insurer.

Hospital Indemnity plans are typically paid for on a monthly basis. What is a hospital indemnity plan. Hospital Indemnity insurance HI provides cash benefits for each day an employee or a dependent is confined in a hospital for a covered illness or injury.

Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. Hospital Indemnity insurance can help lower your costs if you have a hospital stay. There is a hospital indemnity plan available for 50 per month which provides a lump sum hospital confinement of 6350.

This can be especially helpful if the major medical plans. Essentially hospital indemnity insurance can help provide protection or. If you currently offer or are considering moving toward a high-deductible health plan Hospital Indemnity Insurance is a cost-effective way to.

It pays fixed daily dollar benefits for covered services without regard to the. Common examples of the type of benefits these plans may offer are a fixed benefit for admission to the. If you are looking for extra financial protection against the unexpectedly high costs of hospitalization then a hospital indemnity plan may be worth considering especially if you have a high-deductible major medical plan.

The Aetna Hospital Indemnity Plan is a hospital confinement indemnity plan. There are no networks copays deductibles or coinsurance restrictions. Every hospital indemnity plan is different.

The insurance company usually pays this daily benefit amount for up to a year. Therefore policyholders can choose a sum assured that adequately covers their needs and family while. With an indemnity plan sometimes called fee-for-service you can use any medical provider such as a doctor and hospital.

A hospital indemnity plan can work for most people.

How Does Hospital Indemnity Insurance Work With Medicare Medicarefaq

Kemper Health Hospital Indemnity Insurance

Medico How Hospital Indemnity Insurance Fills Medicare Advantage Gaps

Chubb Launches New Hospital Indemnity Product Insurance Business America

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life

Is Hospital Indemnity Insurance Worth It Glg America

Insurance Securian Accident And Hospital Insurance

Why Group Hospital Indemnity Ppt Download

Hospital Indemnity Insurance The Hartford

Selling Hospital Indemnity Coverage Senior Market Advisors

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits

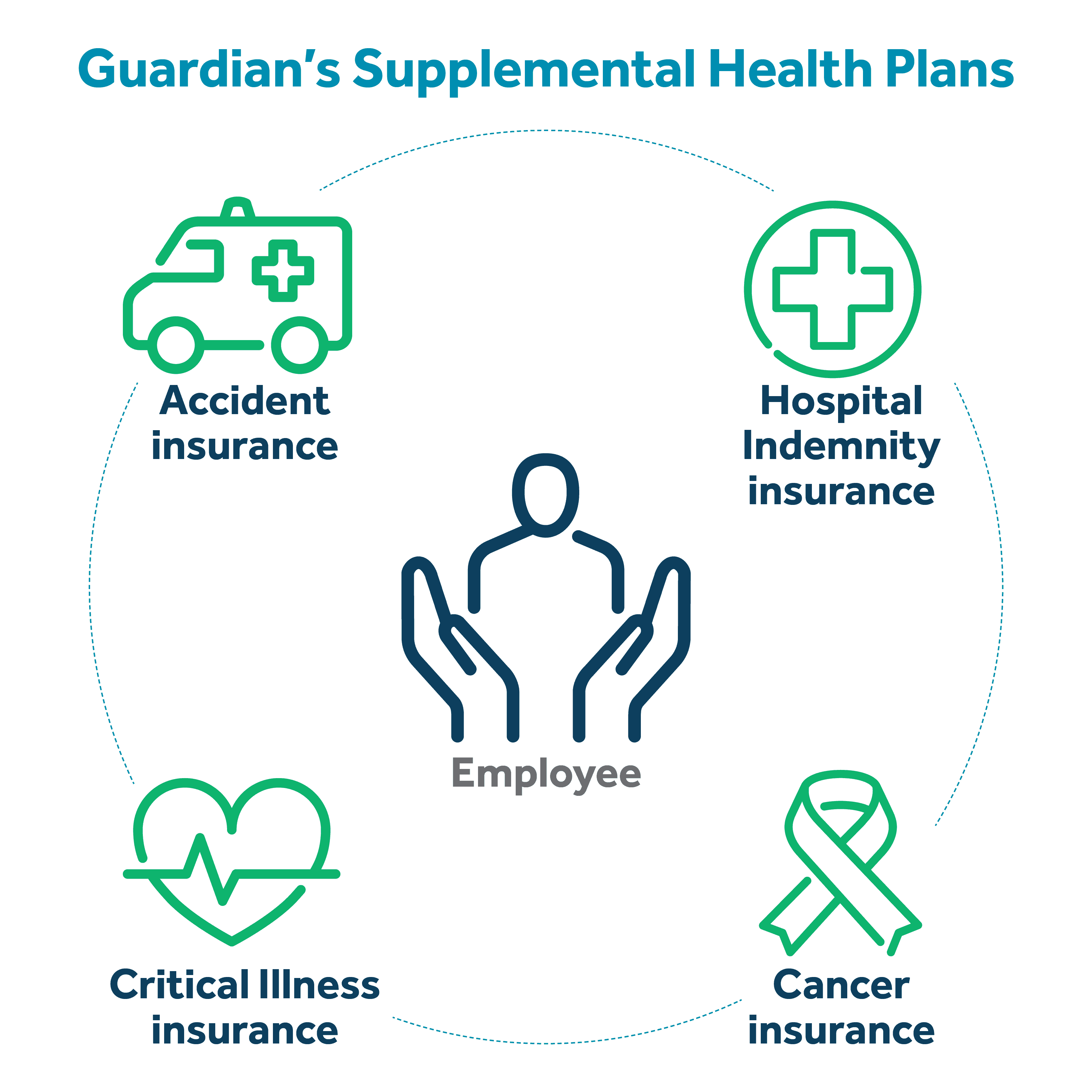

Making Hospital Indemnity Part Of The Mix Guardian

4 Facts You Need To Know About Hospital Indemnity Insurance

Hospital Indemnity Insurance What You Need To Know

What Is Hospital Indemnity Insurance When Is It Worth It Breeze